Investing in mutual funds through a Systematic Investment Plan (SIP) has become one of the most popular ways for individuals to grow their wealth over time. With the potential to create a substantial corpus, SIPs allow investors to start with small amounts and benefit from the power of compounding. In this article, we will explore how investing just ₹1,500 per month can lead to a fund of ₹50 lakhs over time, the mechanics of SIP investments, and essential tips for successful investing.

Understanding SIP Investment

What is SIP?

A Systematic Investment Plan (SIP) is a method of investing a fixed sum regularly in mutual funds. This approach allows investors to buy units of a mutual fund scheme at regular intervals, typically monthly. SIPs are designed to encourage disciplined savings and investment habits.

Key Features of SIP

| Feature | Details |

| Minimum Investment | Starting from ₹500 per month |

| Investment Frequency | Monthly, quarterly, or weekly |

| Investment Duration | Flexible; can be for a few months to several years |

| Compounding Benefits | Earnings on investments generate additional earnings over time |

| Rupee Cost Averaging | Average cost per unit decreases during market fluctuations |

Benefits of SIP Investments

- Affordability: Investors can start with small amounts, making it accessible for everyone.

- Disciplined Investing: Regular investments help cultivate a habit of saving.

- Flexibility: Investors can choose the amount and frequency of their investments.

- Potential for Higher Returns: Investing in equity mutual funds through SIPs can yield significant returns over the long term.

How Does SIP Work?

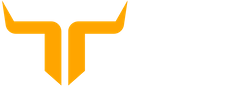

SIPs work by allowing investors to contribute a fixed amount regularly. The investment is used to purchase units of a mutual fund scheme. The number of units purchased depends on the current Net Asset Value (NAV) of the fund.

Example Calculation

Let’s consider an example where you invest ₹1,500 per month in a mutual fund through SIP:

- Monthly Investment: ₹1,500

- Investment Duration: 20 years

- Expected Annual Return: 12% (common average return for equity funds)

Using these parameters, we can calculate the future value of your investment using the formula for SIP returns:

FV=P×(1+r)n−1r×(1+r)

FV=P×

r

(1+r)

n

−1

×(1+r)

Where:

- FV

- FV = Future Value

- P

- P = Monthly investment

- r

- r = Monthly rate of return (annual rate/12)

- n

- n = Total number of investments (months)

Step-by-Step Calculation

- Convert annual return to monthly:

- Expected Annual Return = 12%

- Monthly Rate =

- 12100÷12=0.01

- 100

- 12

-

- ÷12=0.01

- Calculate total months:

- Duration = 20 years

- Total Months =

- 20×12=240

- 20×12=240

- Plug values into the formula:

- FV=1500×(1+0.01)240−10.01×(1+0.01)

- FV=1500×

- 0.01

- (1+0.01)

- 240

- −1

-

- ×(1+0.01)

- Calculate:

- FV≈1500×(1.01)240−10.01×(1.01)

- FV≈1500×

- 0.01

- (1.01)

- 240

- −1

-

- ×(1.01)

- FV≈1500×(9.6463−1)/0.01×(1.01)

- FV≈1500×(9.6463−1)/0.01×(1.01)

- FV≈1500×864.63

- FV≈1500×864.63

- FV≈₹12,969,450

- FV≈₹12,969,450

Thus, after investing ₹1,500 every month for 20 years at an expected annual return of 12%, you could accumulate approximately ₹12.97 lakhs, which is significantly less than ₹50 lakhs.

Reaching ₹50 Lakhs: Adjusting Parameters

To reach a target corpus of ₹50 lakhs, you may need to adjust your monthly investment or the duration:

Option A: Increase Monthly Investment

To find out how much you need to invest monthly to reach ₹50 lakhs in the same duration and rate:

Using the same formula and rearranging it to find

P

P:

P=FV/((1+r)n−1r×(1+r))

P=FV/(

r

(1+r)

n

−1

×(1+r))

Substituting values:

P=5000000/((1+0.01)240−10.01×(1+0.01))

P=5000000/(

0.01

(1+0.01)

240

−1

×(1+0.01))

Calculating this gives you approximately:

P≈₹2,800

P≈₹2,800

This means you would need to invest around ₹2,800 per month at an annual return rate of 12% for 20 years to reach ₹50 lakhs.

Option B: Extend Investment Duration

If you prefer to keep your monthly investment at ₹1,500 but extend your investment duration:

Let’s say you want to keep investing ₹1,500 but want to know how long it will take to reach ₹50 lakhs.

Using the future value formula again and solving for

n

n:

You would need financial software or a financial calculator since solving for

n

nanalytically can be complex without numerical methods.

Tips for Successful SIP Investments

Start Early

The earlier you start investing in SIPs, the more time your money has to grow through compounding.

Choose the Right Mutual Fund

Select mutual funds based on your risk tolerance and financial goals. Look for funds with a consistent track record of performance.

Monitor Your Investments

Regularly review your investments and make adjustments as needed based on market conditions or changes in your financial situation.

Stay Disciplined

Continue contributing regularly regardless of market conditions; this is where rupee cost averaging comes into play.

Avoid Emotional Decisions

Do not let market volatility affect your investment decisions. Stick to your long-term plan.

Conclusion

Investing through a Systematic Investment Plan (SIP) is an effective way to build wealth over time with small contributions. By starting with just ₹1,500 per month and being consistent with your investments, you can potentially accumulate significant wealth through disciplined investing and the power of compounding.

While reaching a target corpus like ₹50 lakhs requires careful planning and possibly higher monthly contributions or extended investment periods, the journey towards financial independence begins with that first step into investing.

Disclaimer:This article provides an overview of SIP investments and calculations based on hypothetical scenarios and expected returns. Actual results may vary based on market conditions and individual fund performance. Always consult with a financial advisor before making investment decisions tailored to your personal financial situation.