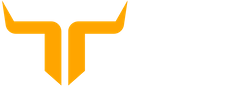

The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme aimed at ensuring a bright future for the girl child in India. Launched as part of the Beti Bachao Beti Padhao initiative, this scheme encourages parents to save for their daughters’ education and marriage expenses. With a minimum monthly deposit of just ₹250, parents can accumulate significant savings over time. This article will provide comprehensive details about the Sukanya Samriddhi Yojana, including its features, benefits, eligibility criteria, and how much money can be accumulated by making regular deposits.

Overview of Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana was introduced on January 22, 2015, by Prime Minister Narendra Modi in Panipat, Haryana. This scheme aims to address the financial concerns related to the education and marriage of girl children in India. It provides parents with a secure way to save money while earning a competitive interest rate.

Key Features of Sukanya Samriddhi Yojana

- Target Beneficiary: The scheme is specifically designed for the girl child.

- Minimum Investment: Parents can start saving with a minimum deposit of ₹250per year.

- Maximum Investment: The maximum limit for deposits is ₹1.5 lakh per year.

- Interest Rate: The current interest rate for SSY accounts is 8.2% per annum, which is higher than many other savings schemes.

- Tenure: The account matures when the girl reaches the age of 21 years or upon her marriage after turning 18.

- Tax Benefits: Contributions to the SSY account qualify for tax deductions under Section 80C of the Income Tax Act.

How Much Can You Accumulate?

One of the most attractive features of the Sukanya Samriddhi Yojana is the potential amount you can accumulate over time with regular deposits. Let’s break down how much money can be saved by depositing ₹250 every month.

Monthly Contribution Calculation

If you contribute ₹250 every month for 15 years (the maximum investment period), your total contributions will be:

Total Contribution=Monthly Deposit×Number of Months

Total Contribution=Monthly Deposit×Number of Months

Total Contribution=₹250×180=₹45,000

Total Contribution=₹250×180=₹45,000

Interest Calculation

Using the current interest rate of 8.2%, we can calculate the maturity amount using the formula for compound interest:

A=P(1+rn)nt

A=P(1+

n

r

)

nt

Where:

- A

- A = the future value of the investment/loan, including interest

- P

- P = the principal investment amount (the initial deposit or loan amount)

- r

- r = annual interest rate (decimal)

- n

- n = number of times that interest is compounded per year

- t

- t = number of years the money is invested or borrowed for

Assuming that interest is compounded annually (

n=1

n=1), we can calculate:

- Total contributions over 15 years = ₹45,000

- Annual interest rate

- r=8.2/100=0.082

- r=8.2/100=0.082

- Time period

- t=15

- t=15

Now we will calculate how much this will grow to at maturity:

Using an online calculator or financial software, it can be determined that:

After 15 years of regular contributions, with compounding interest applied annually, you could potentially accumulate around ₹74 lakh at maturity.

Benefits of Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana offers several benefits that make it an attractive option for parents looking to secure their daughters’ futures:

- High Interest Rate: The current interest rate of 8.2% per annum makes it one of the most lucrative savings schemes available.

- Tax Benefits: Contributions are eligible for tax deductions under Section 80C, providing additional financial relief to parents.

- Long-Term Savings: The scheme encourages long-term savings habits among parents and guardians.

- Government Backing: Being a government-supported scheme ensures that your investment is secure and reliable.

- Flexibility in Deposits: Parents have the flexibility to choose how much they want to deposit within the specified limits.

- Easy Account Management: Accounts can be opened at designated banks and post offices across India, making it accessible for everyone.

Eligibility Criteria

To open a Sukanya Samriddhi account, certain eligibility criteria must be met:

- Age Limit: The girl child must be under the age of 10 years at the time of account opening.

- Account Holder: The account can be opened by a parent or legal guardian in the name of their daughter.

- Number of Accounts: Only one SSY account can be opened for one girl child; however, families with twins or triplets may open more than one account.

How to Open a Sukanya Samriddhi Account

Opening a Sukanya Samriddhi account is a straightforward process that can be done through banks or post offices:

Step-by-Step Process

- Visit a Bank or Post Office: Go to any bank branch or post office that offers SSY accounts.

- Obtain Application Form: Request an application form specifically for Sukanya Samriddhi Yojana.

- Fill Out the Form: Complete all required fields in the application form with accurate details.

- Submit Required Documents:

- Birth certificate of the girl child

- Identity proof and address proof of the parent or guardian

- Passport-sized photographs

- Initial Deposit: Make an initial deposit as per your plan (minimum ₹250).

- Receive Account Details: After successful processing, you will receive an account number and passbook detailing your contributions and balance.

Important Considerations

While investing in Sukanya Samriddhi Yojana offers many advantages, there are some important considerations to keep in mind:

- Maturity Period: The account matures after 21 years from its opening date or upon marriage after reaching 18 years.

- Continuous Deposits Required: To keep the account active, you must make at least one deposit each year until maturity.

- Premature Closure Conditions: Premature closure is allowed only after five years under specific circumstances such as medical emergencies or educational needs.

Frequently Asked Questions (FAQs)

- What is Sukanya Samriddhi Yojana?

It is a government-backed savings scheme designed to promote savings for a girl child’s education and marriage expenses. - Who can open an SSY account?

Parents or legal guardians of a girl child below ten years old can open this account. - What is the minimum and maximum investment?

The minimum investment is ₹250 per year, while the maximum limit is ₹1.5 lakh per year. - What happens if I miss a deposit?

If you miss a deposit in any financial year, your account may become inactive unless you pay a penalty fee to reactivate it. - Can I withdraw money before maturity?

Withdrawals are allowed only after completing five years from account opening under specific conditions such as education needs or medical emergencies.

Conclusion

The Sukanya Samriddhi Yojana stands out as an excellent financial tool designed to secure the future of girls in India through systematic savings and high returns on investments. By contributing just ₹250 monthly, parents can potentially accumulate substantial funds by maturity—around ₹74 lakh—providing significant support towards education and marriage expenses.

This initiative not only encourages saving but also reinforces societal values around empowering girls through education and financial independence. Parents are encouraged to take advantage of this scheme and invest in their daughters’ futures today!

Disclaimer: This article is intended for informational purposes only and does not constitute an official announcement regarding Sukanya Samriddhi Yojana or its associated benefits. Please refer to official government sources or authorized representatives for accurate updates regarding eligibility and application processes related to this scheme.